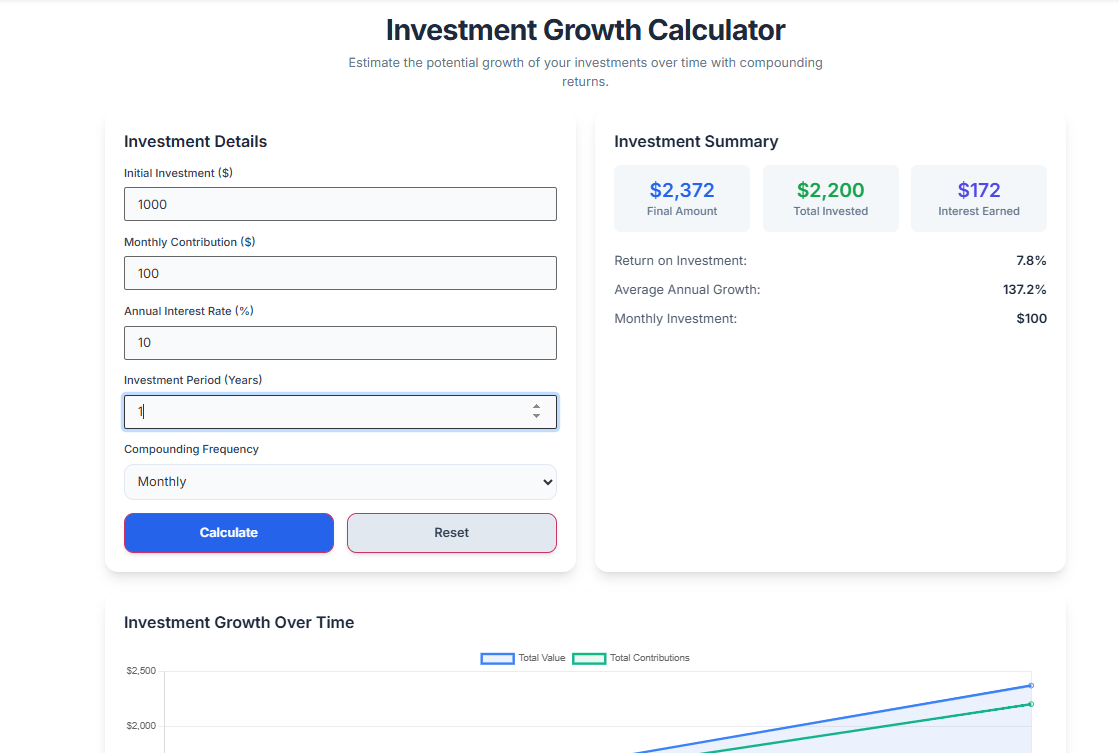

Investment Growth Calculator

Estimate the potential growth of your investments over time with compounding returns.

Investment Details

Investment Summary

$0

Final Balance

$0

Total Invested

$0

Interest

Estimate the potential growth of your investments over time with compounding returns.

$0

Final Balance

$0

Total Invested

$0

Interest

Making a plan for your financial future is one of the smartest moves you can make toward becoming independent, and using a dependable Investment Growth is where you start. This handy tool is all about showing you how your money could potentially grow over time, thanks to the magic of compound interest.

When you’re planning your finances, getting things right and making it easy for you are top priorities. Here’s what makes our Investment Calculator really shine:

Trustworthiness: We use the standard, reliable formulas that finance experts use for compound interest. This means every single cent is calculated accurately based on the numbers you provide.

Lightning-Fast Results: Our calculator is built with lean, optimized code, so the math happens instantly right before your eyes. No waiting around—answers pop up as soon as you type or click.

Simple and Clear Design: We believe in keeping things straightforward. The layout is clean and uncluttered, with easy-to-read text, so you can concentrate on the figures that count.

Dynamic Visuals: Unlike basic calculators that just spit out numbers, ours creates an interactive line chart for you. This visual helps you quickly see and understand the big difference between simple saving and the power of compound growth.

Completely Free: There are zero hidden costs, no subscriptions needed, and no paywalls. You get a professional-level financial tool, absolutely free of charge.

Our Investment Calculator is designed with a smart yet easy-to-use interface. Below, you’ll find a detailed look at every feature the tool offers and how the technology behind it turns your inputs into useful financial information.

Investment Details Section

Think of this as the main control panel where you set up your financial situation.

Initial Investment ($): Right at the top of the form, you’ll find this field where you can type in the amount you’re starting with. Whether it’s $100 or $10,000, this number is the starting point for how your money will grow. The box is set up to take any number, and you can easily change it in steps of 100.

Monthly Contribution ($): Keeping up with regular contributions is a big part of investing. Use this part to add any regular amounts you plan to save or invest each month. It starts with a suggestion of $500, but you can adjust it to fit your budget perfectly. The calculator adds this money to your balance at the end of each month before working out the interest.

Annual Interest Rate (%): This is where you tell the calculator how fast you expect your money to grow. Type in the rate you think you’ll get back (like 7% for average stock market returns, or 2% for a high-yield savings account). You can be very specific, too—the tool works with decimal numbers, so you can enter exact rates like 4.5% or 8.2%.

When it comes to investing, time really is your ally. This part of the tool lets you pick how long you plan to keep your money invested, anywhere from 1 year out to a full 50 years. Thinking about this timeframe helps you see the difference between short-term plans and long-term dreams.

And how investments grow can vary too. This dropdown menu gives you four choices for how often the growth is calculated:

Monthly (12 times a year): This works great for things like savings accounts or when dividends are paid out and reinvested every month.

Quarterly (4 times a year): A lot of dividend stocks use this schedule.

Semi-Annually (2 times a year): You’ll often see this with bonds.

Annually (1 time a year): This is the standard for just getting a basic idea of growth.

Picking a different frequency here changes the math used to figure out exactly how much “Interest Earned” you’ll see.

The Calculation Engine

Once you’ve entered your data, you can hit the blue “Calculate Growth” button. But here’s the cool part: the tool is smart enough to calculate as you type, giving you instant feedback. When you trigger the calculation, the engine works its magic, running through each month of your chosen time period, adding your contributions, and applying the interest rate.

Investment Summary & Breakdown

The results pop up in a neatly organized “Results Section” with three key summary cards:

Final Amount (Blue): This shows the total value of your portfolio once the time is up.

–Total Invested (Green): This is the actual cash you’ve put in, including your initial investment and any monthly contributions.

Interest Earned (Indigo): This is the “free money” your interest rate earns for you—often the most exciting number to see!

Below those cards, you’ll find a detailed breakdown with your Return on Investment (ROI) percentage and Average Annual Growth, giving you a closer look at how effective your strategy is.

Interactive Growth Chart

At the bottom, the Investment Calculator displays a dynamic line chart using Chart.js. The graph shows two lines:

Total Value (Blue Area): This highlights the exponential growth of your wealth over time.

Total Contributions (Green Line): This shows the steady path of your deposits. The widening gap between these lines is a visual reminder of the power of compound interest.

This Investment Calculator is a real asset for your financial well-being, offering some great perks:

Visual Motivation: When you see the “Interest Earned” line on the chart climb past your “Total Invested,” it’s an incredibly motivating sight that encourages you to keep saving.

Scenario Planning: You can easily play around with “What If” ideas. For instance, you might ask, “What if I put away an extra $50 each month?” or “What if my returns were 1% higher?” This tool lets you test these scenarios in a snap.

Error-Free Math: Calculating compound interest involves some complex math with exponents and logarithms, which can be tricky to do by hand. This tool takes care of all that complicated math instantly and accurately for you.

Goal Setting: It helps you figure out what you need to do to reach your financial goals. If you’re aiming for $1 million in 20 years, you can adjust the numbers until you find out exactly how much you need to contribute each month to get there.

Education: It’s also a fantastic learning tool. It clearly shows you how often your interest compounds and how long you’re investing for can really make a difference in your total returns.

This Investment Calculator is a great tool to help you plan, but keep a few things in mind:

It’s an Estimate: The results show you what *might* happen based on the numbers you enter. Remember, real-world investing involves ups and downs, so your actual returns might be different from the steady percentage you put in.

Inflation Isn’t Factored In: The calculator shows you how much your money could grow in raw dollars. It doesn’t automatically account for inflation, which means the money you get in the future might not buy as much as it seems like it will today.

Assumes You Contribute Every Month: The calculation works on the idea that you’ll add money every single month without fail. Real life can get in the way sometimes, and your ability to save regularly might change.

Taxes Affect the Final Amount: The “Final Amount” you see doesn’t include taxes. Depending on where you live and the type of account you’re using (like a 401k, IRA, or regular investment account), you’ll likely owe taxes, so what you actually keep might be less.

The Investment Calculator is mathematically precise based on the inputs you provide. It uses standard compound interest formulas used by financial institutions. However, because it assumes a fixed interest rate every year (which rarely happens in the stock market), the results should be viewed as a theoretical forecast rather than a guarantee.

Yes, absolutely. The tool includes a specific field for “Monthly Contribution.” This allows you to model a standard investment strategy, such as Dollar Cost Averaging (DCA), where you invest a fixed amount of money at regular intervals regardless of the share price.

Yes, this Investment Calculator is 100% free to use. There are no limits on how many times you can calculate, and you do not need to create an account or provide any personal financial information to use the tool.

The tool calculates interest based on the “Compounding Frequency” you select (Monthly, Quarterly, Semi-Annually, or Annually). For example, if you choose “Monthly,” the annual interest rate is divided by 12 and applied to your balance each month, allowing your interest to earn more interest at a faster pace than annual compounding.

Toolota is your all-in-one online tools platform. Fast, simple, and free utilities designed to make everyday digital tasks easier and smarter.