Total Assets

0.00Total Liabilities

0.00Your Net Worth

Enter your financial details to calculate your current standing.

Evaluate your financial status by calculating the difference between your total assets and total liabilities.

Enter your financial details to calculate your current standing.

Figuring out where you stand financially is the very first, and most important, step towards achieving true financial independence. Think of the Net Worth Calculator as a basic tool that helps you see your real financial situation. It does this simply by taking everything you own (your assets) and subtracting everything you owe (your liabilities).

You know, there are tons of online calculators out there, but the Toolota Net Worth Calculator really stands out. We’ve put a lot of thought into making it super easy and pleasant to use, focusing on speed, keeping your info safe, and making sure everything is crystal clear.

We built the tool using clean, modern tech like Tailwind CSS, so it looks great and works smoothly on any device you use—whether that’s your desktop, tablet, or phone. It just adapts and stays intuitive no matter what.

The best part? It works in real-time. Instead of making you hit a ‘Calculate’ button every single time, the calculator updates right away as you type in or change any numbers. This immediate feedback really helps you stay engaged with your finances.

And we keep it reliable by sticking to the basic, universal formula everyone uses: Assets minus Liabilities equals Net Worth. We’ve organized all the typical financial items into clear sections for assets and debts, so nothing gets missed. This organized setup, plus the instant calculations, lets you see right away how adding to your savings or taking on more debt affects your bottom line. It’s a great way to get smarter about your money.

Choosing the Toolota Net Worth Calculator means you’re going with a solution you can trust, it’s completely free, and it’s incredibly efficient for keeping an eye on one of your key financial numbers.

The Toyotal Net Worth Calculator works entirely on your device, using your web browser and JavaScript to do all the calculations. This means everything happens right there, securely, giving you instant results without ever sending your private financial details to any server. Looking at the code and how it’s built, you can see it’s a solid and easy-to-use tool.

3.1. How You Enter Your Info: Assets and Liabilities

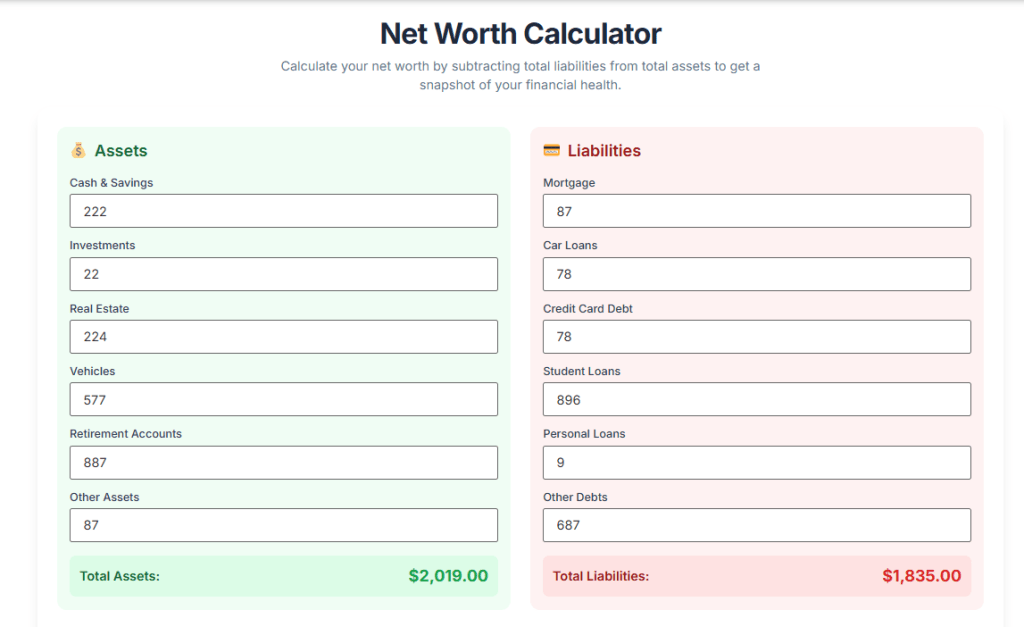

The main part of the calculator is split into two clear sections: one for what you own (Assets) and one for what you owe (Liabilities).

Assets Section: This part is where you list everything you own that’s worth money. It has separate spots to enter different types of assets:

Cash: Here you can put in the money you have in checking and savings accounts.

Investments: This is for any investments you have outside of retirement accounts, like stocks, bonds, mutual funds, or regular brokerage accounts.

Retirement: This spot is just for money you’ve saved in retirement plans, like 401(k)s, IRAs, or pensions.

Home Equity: You’d enter the current market value of your main home, minus any remaining mortgage balance. This gives you the true value of your home as an asset.

Vehicles: This is where you list the current value of your car, motorcycle, boat, or any other vehicles.

Other Assets: This flexible space lets you add the value of other things you own that have worth, like jewelry, art, or maybe your share in a business.

The Liabilities Section is all about keeping tabs on what you owe—basically, your debts and financial commitments. It includes places to enter common kinds of debt:

Mortgage: This is the amount you still owe on your home loan.

Car Loans: Any money you haven’t paid off on your vehicle financing.

Student Loans: The total amount you owe for your education.

Credit Card Debt: All the balances you still have on your credit cards.

Other Liabilities: A general spot for any other debts, like personal loans, medical bills, or payday loans.

What makes this Net Worth Calculator special is the JavaScript function called calculateNetWorth. Every input field in both the Assets and Liabilities sections has an ‘input’ event listener (as the code shows). This means that the moment you type or change a number in any field, the calculateNetWorth function kicks in right away. This is a really important feature because it gives you instant feedback, letting you see immediately how any change to your assets or debts affects your total net worth. It’s much better than having to press a button manually. The function adds up all your assets to figure out totalAssets, adds up all your liabilities for totalLiabilities, and then works out your final net worth.

3.3. Making Sense of Your Results

Once the calculations are done, your financial picture will be clearly presented right there for you to see.

Total Assets: This shows you the overall value of everything you own, like property and investments.

Total Liabilities: This displays the total amount of debt you’re carrying.

Net Worth: This is the big number you’re looking for – it’s simply your total assets minus your total liabilities.

Net Worth Status: The tool will easily tell you if your net worth is “Positive,” “Negative,” or “Zero.” It uses colors to make this status super clear at a glance.

Percentage Bars: A cool feature of the Toolota Net Worth Calculator is the way it visually shows your assets and liabilities as percentages. These bars, along with the actual numbers, give you a quick visual way to see how your assets stack up against your debts. For instance, if your assets and debts are equal, both bars will show 50%, indicating a net worth of zero. If your assets are twice as much as your debts, the asset bar will be noticeably larger, giving you a powerful visual way to track your financial progress.

3.4. Interactive Features: Clear and Recalculate

This tool comes with two handy buttons to help you manage the data you’re working with:

Clear Button: If you need to start fresh, just click this button. It immediately wipes all the numbers in your asset and liability fields, setting them back to zero. You’ll see a quick message confirming, “All fields cleared!” This makes it easy to begin a new calculation or try out different financial situations using the Net Worth Calculator.

Calculate Button: While the calculator works automatically in real-time as you type, this button is still available. Clicking it manually runs the calculation (using the calculateNetWorth function) and shows a “Net worth recalculated!” notification. This can be helpful if you’ve just loaded the page, or if you simply want to confirm the current result without actually changing any of the input numbers.

Using a top-notch financial tool like the one from Toolota brings a lot of real, noticeable advantages for managing and planning your personal finances.

Speed and Accuracy

Since the calculator runs directly in your browser using JavaScript, it calculates results almost instantly. There’s no waiting around for a server to respond, so you get real-time answers as soon as you input your information. Plus, its accuracy is locked in because it sticks closely to the standard Net Worth Calculator formula, cutting out the kind of mistakes that can easily happen when doing math by hand in spreadsheets.

Financial Clarity and Planning

This calculator gives you a clear, unbiased picture of where you stand financially. By bringing all your assets and debts together in one easy-to-see place, it quickly points out the areas where you might need to focus your efforts. This starting point is super important for setting smart financial goals – whether you’re dreaming of retiring early, saving up for a house down payment, or just wanting to pay down debt. Seeing the numbers, including the percentages of assets versus liabilities, really helps you understand your financial situation at a glance.

The Toolota platform features a sleek and modern design. Built using contemporary technology, its interface is incredibly clean, free from clutter, and genuinely user-friendly. It’s not just visually pleasing; the layout is carefully planned to help you easily navigate the steps for listing your assets and debts. This thoughtful approach cuts down on confusion and makes you more likely to use it regularly. Thanks to this approachable design, figuring out your Net Worth is a straightforward and unintimidating process.

What makes the Toolota Bulk Price Calculator so powerful is its straightforward, easy-to-use one-step process, all backed by solid code. By taking a closer look at the HTML file’s structure, we can really understand how this efficient tool handles your data and gives you results right away.

Step 1: The Three Key Things You Need to Enter

To get the calculator working its magic, you just need to provide three essential pieces of information. These are clearly marked, and they’re the only things you need to tap into all the Bulk Price Calculator’s features.

Product Name: This text field (with the ID `product-name`) lets you type in the name of the item. While the actual calculation doesn’t use this name, it’s really handy for labeling your results. This makes it simple to keep track of prices for different products and easy to copy them later.

Unit Price: This is where you enter the standard cost for just one item (field ID: `unit-price`). It’s important that you enter a number here; otherwise, the calculation won’t work.

Quantity: This is the crucial field (ID: `quantity`) where you input the total number of units you want to buy. The number you put here determines which discount level will be applied to your purchase.

Step 2: Meet the Automated 5-Tier Discount Engine

What really powers the Bulk Price Calculator is its 5-tier discount setup. It’s built-in, super clear, and always gives you reliable, consistent pricing based on how much you buy. The JavaScript code behind it all simply checks which is the best discount tier your order quantity fits into.

Here’s how those set discount tiers break down:

While the Toolota Net Worth Calculator is a really helpful and accurate tool, it’s important to keep in mind what it can and can’t do, and how to get the best results from it.

It All Starts With Your Data

The results you get from the Net Worth Calculator are only as good as the information you put into it. If you guess too high on the value of things you own (like your house or car) or forget to list all your debts (even small personal ones), your final net worth number won’t be correct. Always try to use the most recent, realistic market values for your assets and the exact amount you actually owe for all your liabilities.

Think of It as a Starting Point, Not Final Advice

This tool is great for crunching numbers, but it’s not designed to give financial advice. When you’re planning your finances, any decisions you make based on the number this calculator gives you should definitely be double-checked with a qualified financial advisor. Think of the result as a good starting point for a conversation, not a complete financial plan on its own. It works best when it’s part of a bigger, professional financial strategy, not used all by itself.

Use It Responsibly

This Net Worth Calculator is meant to help you understand your personal or business finances better – it’s purely for informational and educational purposes. Please don’t use it for anything illegal, dishonest, or harmful. That includes things like trying to create misleading financial reports or deceptive statements.

A: Most financial experts recommend calculating your Net Worth Calculator score at least once or twice a year, ideally on a specific date (like January 1st or your birthday). This consistent tracking creates reliable benchmarks, allowing you to clearly measure your financial progress and the effectiveness of your saving and investing strategies over time.

A: The main difference is whether the item puts money into your pocket or takes money out of it. An asset is something you own that has positive economic value, like cash, investments, or real estate. A liability is a financial obligation or debt that you owe to others, such as mortgages, loans, or credit card balances. The Net Worth Calculator simply finds the residual value between these two categories.

A: While a positive score is the ultimate goal, a negative Net Worth Calculator score is not always a terrible sign, particularly for young individuals who have recently taken on significant student loan debt or a new mortgage. In these cases, liabilities (like debt) are front-loaded to acquire future assets (like a degree or a home). However, if your score remains negative deep into your career, it signals an urgent need to pay down high-interest debt and focus on asset growth.

A: By using the Net Worth Calculator consistently, you can establish a clear baseline of your current financial standing. You can then use the retirement and investment asset fields to track the growth of your retirement savings against your financial goals. By monitoring the changes in your total assets (and reducing liabilities), you gain motivation and empirical data to adjust your savings and investment rates to reach your desired retirement Net Worth Calculator target.

Toolota is your all-in-one online tools platform. Fast, simple, and free utilities designed to make everyday digital tasks easier and smarter.