Budget Planner – 30-Day Efficient Money Tracker | Toolota

Table of Contents

What is the Budget Planner Tool?

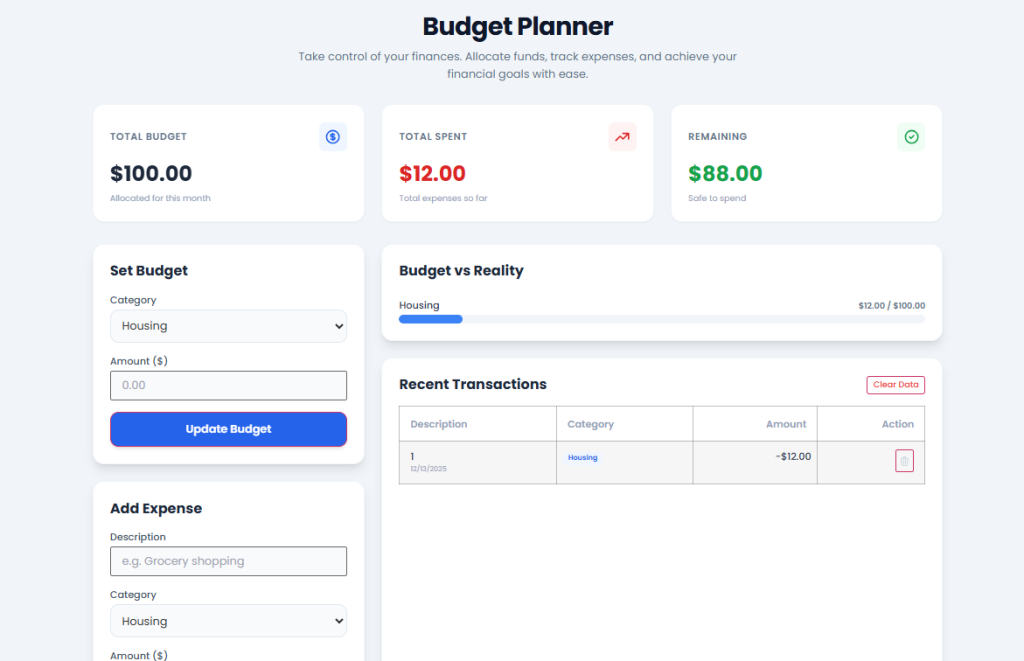

Getting control of your finances all starts with understanding where you stand, and that’s exactly what our innovative Budget Planner is here to help you achieve. Think of the Toolota Budget Planner as your comprehensive personal finance helper, designed to simplify the often tricky business of managing money. It moves beyond old-fashioned spreadsheets and notebooks, offering you a dynamic, visual, and super easy-to-use tool to keep tabs on every dollar you earn and spend.

Why Choose Toolota's Budget Planner?

Looking for the ideal financial partner? You need something dependable, swift, and straightforward. Toolota’s Budget Planner really stands out because it focuses on being user-friendly and keeping your data accurate, making money management hassle-free, just like they say.

Trustworthy with Local Storage: Unlike apps that depend only on cloud servers, this Budget Planner uses the storage right in your web browser. This means your important financial details—like budgets and expenses—are kept safely on your own device. This setup gives you more privacy and makes sure your financial records are always there, even if you lose your internet connection for a bit.

Precise Calculations: The tool includes a solid system for working out totals, including your overall budget, total spending, and that crucial current balance. Plus, it uses standard currency formats for your region, so all the amounts look clear and correct, helping you avoid any mistakes from doing calculations by hand.

Quick and Responsive: Made with smart client-side JavaScript, the app runs incredibly fast. When you add a new expense or set a new budget, you see instant updates on your main dashboard and in the graphs, giving you immediate insight into your financial situation.

What really sets this tool apart is its unique visualization features, thanks to the inclusion of Chart.js. This handy tool lets the Budget Planner turn plain numbers into clear, eye-catching charts, often showing how expenses are broken down by category. Seeing your data this way is super helpful for spotting spending patterns and any potential issues that might get lost in a sea of numbers.

And the user interface? It’s designed with Tailwind CSS, a utility-first framework, giving the app a sleek, modern look that’s a pleasure to use. It’s super intuitive and easy on the eyes, so navigating it is a breeze. You won’t get bogged down with complicated menus—everything you need, like setting budgets, adding expenses, checking summaries, and viewing transactions, is all right there on one simple screen.

How This Budget Planner Works (A Deep Dive into the Tool)

The charm of the Toolota Budget Planner is how simple and clear its structure is, broken down into just three main parts: Input Forms, a Summary Dashboard, and Transaction History/Visualization. This section takes a closer look at exactly how the tool works, following the structure set out in the HTML.

Digging into the Details of Input

The tool has two main forms for you to enter your data:

Budget Form (Setting Limits)

Category Picker: This is a key dropdown menu that lets you decide where your planned money should go. It comes with standard categories like Income, Housing, Food, and Transport, plus optional ones like Entertainment, and there’s even an ‘Other’ category for anything else. This helps you budget with specific goals in mind.

Budget Amount Box: This is a special number field where you type in the maximum amount you plan to spend (or the income you expect) for the category you’ve picked, over the budgeting period you’ve set. After you hit submit, the addBudget function kicks in, calculating this and updating the totalBudget shown in the summary.

Expense Form: Keeping Tabs on Your Spending

Description of Expense: This is a straightforward text box where you can jot down a clear and detailed description of what you bought (for instance, “Monthly Rent Payment” or “Groceries at Trader Joe’s”). This helps you keep a close eye on every little purchase and makes it easy to check your records later.

Category of Expense: This is a dropdown menu that matches the categories you set up in the Budget Form. By assigning your spending to a specific category, you can see exactly how much you’ve spent against your budget, which is key to figuring out how much you have left in each area.

Amount of Expense: Here, you can enter the exact cost of the item using a number input field. Once you submit the form, the addExpense function kicks in, which then sets off the main process that updates your spending summary.

Expense Form: Keeping Tabs on Your Spending

Description of Expense: This is a straightforward text box where you can jot down a clear and detailed description of what you bought (for instance, “Monthly Rent Payment” or “Groceries at Trader Joe’s”). This helps you keep a close eye on every little purchase and makes it easy to check your records later.

Category of Expense: This is a dropdown menu that matches the categories you set up in the Budget Form. By assigning your spending to a specific category, you can see exactly how much you’ve spent against your budget, which is key to figuring out how much you have left in each area.

Amount of Expense: Here, you can enter the exact cost of the item using a number input field. Once you submit the form, the addExpense function kicks in, which then sets off the main process that updates your spending summary.

How Editing and Managing the Budget Planner Works

Think of the Budget Planner as a dynamic document that evolves with your financial information. To keep everything accurate and up-to-date, the tool includes specific features for managing your data:

Transaction List: This is where you’ll see all your recorded expenses and budget entries. They’re displayed in a neat, scrollable table, making it easy to view details like the Date, Description, Category, and Amount for each item.

Deleting Entries: If you need to remove a specific transaction, every entry in the list comes with a delete option. When you click it, the tool runs a process to remove that item from your saved data. It then automatically recalculates your budget summary and updates the entire dashboard and charts right away to reflect the change.

Clearing All Data: For a fresh start, there’s a dedicated “Clear All Data” button. Using this will completely wipe all your budget and expense records from the storage on your device. This effectively resets the Budget Planner, ready for a new budgeting period or for a new user.

Benefits of Using the Budget Planner

Using a focused and powerful budget planner, like Toolota’s, comes with clear benefits that directly boost your financial well-being.

Precise Financial Tracking: This tool uses dedicated forms and exact calculations to cut down on the mistakes that often happen when tracking finances by hand in a notebook or a basic spreadsheet. It guarantees that your summary is always based on the exact numbers you provide.

Quick Insights on Your Finances: Thanks to instant calculations and easy-to-see visuals, you get helpful insights right away. You don’t have to wait until the month is over to see where you stand; every time you log an expense, you see your current financial situation update in real-time.

Organization for Financial Clarity: Although it’s a finance app, its emphasis on clear, organized data is like the financial version of SEO—it makes your financial information (your data) neat, easy to find, and simple to understand, helping you make the best choices.

Easy-to-Use Interface: Thanks to Tailwind CSS, the design is clean and simple, focusing on what you need. All the important features are right where you can see them, making it easy for new users to get started.

Neat UI and Helpful Tools: The easy input fields, summary sections, and interactive charts make managing your data feel less like a chore and more like a productive activity.

Conditions for Optimal Budget Planning

Here are a few tips to make the most of the Toolota Budget Planner:

Think About Input Quality First: Remember the saying, “Garbage In, Garbage Out”? It’s a key idea in budgeting. Your budget summaries and charts will only be as good as the information you put in. Make sure to carefully record all your expenses and set budget limits that are realistic.

Don’t Skip the Manual Check: Even the best digital tools need a human eye. It’s important to regularly look over your transaction list and category chart. This helps you catch any mistakes and spot any unexpected spending habits. Taking this step can help you avoid any financial surprises down the road.

Basic Steps for Best Results: To get the most out of tracking, begin by adding your total income as a budget item, along with your fixed expenses like housing and utilities. Then, just add your variable expenses as they happen. This approach helps you prioritize saving money.

Keep It Legal and Positive: As a financial tool, this planner is meant for honest personal money management. Please don’t use it to track or plan anything illegal.

Frequently Asked Questions (FAQ) About the PDF to JPG Converter