EMI Calculator

Calculate Equated Monthly Installments for home, car, and personal loans with a detailed breakdown.

Monthly EMI

0.00

Total Payable

0.00

Total Interest

0.00

Calculate Equated Monthly Installments for home, car, and personal loans with a detailed breakdown.

Monthly EMI

0.00

Total Payable

0.00

Total Interest

0.00

Making a big financial move like taking out a loan for a home, car, or education is a pretty major step these days. Getting it right really comes down to understanding your EMI – that’s your Equated Monthly Installment. Trying to figure out the actual cost of borrowing without a good calculator can be a real headache, take up a lot of time, and could easily lead to mistakes in your budget.

What This Tool Does:

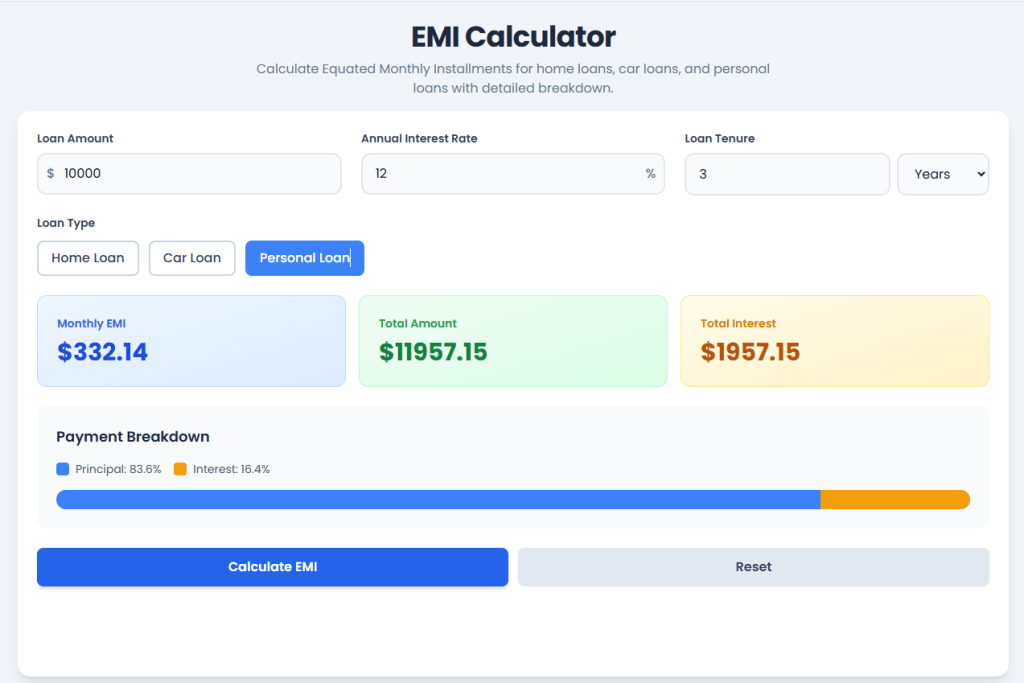

The Toolota EMI calculator is super handy for figuring out exactly how much you’ll need to pay back each month on a loan. It quickly calculates the fixed monthly repayment, covering both the amount you borrowed (the principal) and the interest, spread out over the time you have to pay it back.

All you need to do is plug in three simple details: how much you’re borrowing, the annual interest rate, and how long the loan will last. The calculator then uses a standard, widely accepted formula (the reducing-balance method) to give you a clear, detailed schedule of your monthly payments. Basically, it turns complex financial math into easy-to-understand numbers you can actually use.

How It Works:

The calculator uses a core formula to determine your EMI (Equated Monthly Installment):

EMI = P × R × (1+R)N / [(1+R)N – 1]

Think of it like this: ‘P’ is the amount you initially borrowed, ‘R’ is your monthly interest rate (which the tool calculates from your annual rate), and ‘N’ is the total number of months you have to repay the loan.

The Toolota interface is smart – it automatically converts your inputted annual interest rate and loan duration (whether you enter years or months) into the correct monthly figures. This gives you an instant result that matches how banks actually calculate things. Plus, the calculator updates automatically as soon as you change any of the numbers, so you get immediate feedback on how different choices affect your payments.

Who Should Use It:

Pretty much anyone thinking about taking out a loan should use an EMI calculator. This includes loans that are secured (like for a home or car) and those that aren’t (like personal or student loans).

It’s especially useful if you’re:

A first-time borrower who wants to get a clear picture of what a loan will actually cost you each month.

Comparing different loan offers from various banks or lenders to find the best deal.

Someone planning your budget who needs to know exactly how a fixed monthly loan payment will fit into your finances.

What Problems It Solves

The Toolota EMI calculator mainly tackles the issues of guesswork and potential mistakes. It gets rid of the errors that often happen when people calculate manually, and it clearly shows the difference between how much you’re paying back on the original loan amount versus the interest. This clear breakdown helps users avoid stretching their finances too thin and prevents that awkward surprise when you finally realize the full cost of borrowing much later on.

Why Choose Us (Toolota)

Reliability: Our EMI calculator uses the exact mathematical formulas that banks and financial institutions around the world trust. This means every result you get is highly dependable and follows industry standards.

Accuracy: The tool expertly handles the tricky part of converting annual interest rates into monthly ones and makes sure loan terms are correctly set in months. This guarantees that the final monthly EMI figure you see is spot on.

Speed: Our calculation engine is built for quick results. Unlike some calculators that make you hit a separate “Calculate” button, Toolota has a neat feature: it calculates automatically whenever you change any number. Just type or adjust a figure, and the EMI result updates right away.

What Problems It Solves

The Toolota calculator mainly tackles the issues of guesswork and potential mistakes. It gets rid of the errors that often happen when people calculate manually, and it clearly shows the difference between how much you’re paying back on the original loan amount versus the interest. This clear breakdown helps users avoid stretching their finances too thin and prevents that awkward surprise when you finally realize the full cost of borrowing much later on.

Why Choose Us (Toolota)

Reliability: Our EMI uses the exact mathematical formulas that banks and financial institutions around the world trust. This means every result you get is highly dependable and follows industry standards.

Accuracy: The tool expertly handles the tricky part of converting annual interest rates into monthly ones and makes sure loan terms are correctly set in months. This guarantees that the final monthly EMI figure you see is spot on.

Speed: Our calculation engine is built for quick results. Unlike some calculators that make you hit a separate “Calculate” button, Toolota has a neat feature: it calculates automatically whenever you change any number. Just type or adjust a figure, and the EMI result updates right away.

The Toolota EMI calculator is so effective because it’s incredibly simple to use, all thanks to some really solid code working behind the scenes. The tool is neatly divided into two parts: the place where you enter your loan details (the Inputs Panel) and the spot where you see the amazing results breakdown (the Results Panel).

Key Details You Need to Enter: Loan Amount, Interest Rate, and Loan Term

The panel on the left is where you start setting things up. Think of it as your financial planning dashboard, not just a regular text box (as noted in the analysis of emi_calculator.html).

Loan Amount Field: This is where you put in the total amount of money (the Principal, or P) you plan to borrow. It usually comes pre-filled with a value like $500,000, which makes it easy to test things out quickly (according to the analysis).

Interest Rate Field: Here, you type in the Annual Interest Rate (p.a.) that your lender is offering. Remember, even a tiny change in this number can make a big difference to your total cost over time.

Loan Term Selector (Switch Between Years and Months): This feature combines two things into one (as mentioned in the analysis). You enter the number of time units, and right next to it, there’s a dropdown menu where you can choose whether those units are Years or Months. This makes it super convenient because the calculator takes care of converting everything into total months (N) automatically in the background.

Meet the Instant Calculation Engine!

Ever wonder how your inputs become an AI result? Here’s the scoop: the calculator springs into action the moment you tweak any of the three input fields (as seen in the analysis of emi_calculator.html). Its JavaScript engine is super quick—it zips the annual interest rate down to a monthly rate (R) and stretches the loan term out into total months (N). Then, it feeds these figures, along with the Principal (P), into the standard EMI formula. What pops out is your fixed monthly EMI amount, which is the “AI output” for this tool—the exact figure you need to tackle your debt (from the analysis of emi_calculator.html).

Get a Clear Picture of Your Repayment Plan

Over on the right side, you’ll find the results section, which is all about making things crystal clear:

EMI Amount: This is the big one—the precise, fixed sum you’ll be paying each month (based on the analysis of emi_calculator.html).

Total Amount Repayable: Think of this as the grand total: your Principal plus all the interest tacked on.

Total Interest Payable: This shows you the real cost of your loan, laid out plain as day (from the analysis of emi_calculator.html).

Principal/Interest Visualization Bar: This nifty graphic does the math in real time to show you what chunk of your Total Repayable Amount goes to the Principal versus Interest (also from the analysis of emi_calculator.html). It’s a great way to grasp the full picture of what borrowing will cost you over time.

Advanced User Controls

Manual Calculation & Notification: Even though the tool automatically calculates everything for you, you can manually trigger a recalculation by simply clicking a dedicated ‘Calculate’ button. When you do this, a quick, helpful pop-up will appear to let you know the calculation is finished. (Based on the analysis of emi_calculator.html).

Reset Button: If you want to start fresh or compare different scenarios, the ‘Reset’ button is there to help. It instantly clears all your inputs and sets them back to their original defaults (like $500,000, 8% interest, and 5 years), making it easy to test things out. (Based on the analysis of emi_calculator.html).

Copy & Download Features: To make it simple to share your results or keep a record of them, there are special buttons for you. You can easily ‘Copy to Clipboard’ or ‘Download as PDF/Image’. (Based on the analysis of emi_calculator.html).

Using the Toolota calculator is a smart move for managing your finances wisely. Here’s why:

Accuracy That Saves Time: It quickly does all the complex math with pinpoint accuracy, so you don’t have to worry about mistakes you might make doing it yourself.

Better Budgeting & Planning: Knowing exactly what your monthly EMI will be helps you plan your budget better and see how the loan payment fits into your overall cash flow and lifestyle.

Easy Option Comparison: You can easily play around with different scenarios, like comparing a shorter loan period with higher payments against a longer one with lower payments, to find the best fit for your budget.

Clear Cost Picture: It clearly shows you the total interest you’ll pay, so you know the full cost upfront before you decide to take out the loan.

Supports Good Credit:** By helping you choose an EMI you can comfortably afford, it helps you avoid missing payments, which is key to keeping your credit score healthy.

The Toolota EMI is a handy and dependable tool, but it’s important to keep a few things in mind:

The results you get rely heavily on the information you put in. To make sure you get an accurate result, double-check that the loan amount, interest rate, and loan term match exactly what your lender has told you.

Remember, the calculator gives you an estimate. It won’t include things like processing fees, stamp duty, or charges for paying off your loan early. Always carefully read the final loan agreement from your bank before you sign anything.

This tool uses a standard calculation method called reducing-balance, which is the usual way home and personal loans are structured.

Lastly, this is purely a financial tool. It’s not meant for any kind of illegal or harmful activities.

The Toolota calculator features a toggle that allows you to input your loan tenure in either Years or Months. Internally, the tool’s engine automatically converts the chosen tenure into the total number of monthly installments (‘N’) required by the standard EMI formula. This ensures the EMI calculation is always accurate without requiring you to perform manual unit conversion.

To calculate an accurate EMI figure, the Toolota EMI calculator requires three key inputs: the Principal Loan Amount (P), the Annual Interest Rate (R), and the Loan Tenure in months or years (N). The calculator then uses these three variables to generate the fixed monthly installment amount, along with a full breakdown of the total interest and principal components.

The Toolota EMI calculator features a unique Results Visualization Bar in the right-hand panel. After the EMI is calculated, this dynamic bar instantly updates to graphically represent the percentage split between the Principal and Interest components in your total repayment amount. This feature offers amazing transparency into the long-term cost of your loan.

Yes, absolutely. The EMI calculator is a must-use tool for comparison. Because it offers instant, accurate results and auto-calculates on every input change, you can quickly enter the terms (Rate and Tenure) from different lenders to compare the resulting monthly EMI and Total Interest. The built-in Reset function also allows you to quickly start a new comparison from the default state.

Toolota is your all-in-one online tools platform. Fast, simple, and free utilities designed to make everyday digital tasks easier and smarter.