Simple Interest Calculator

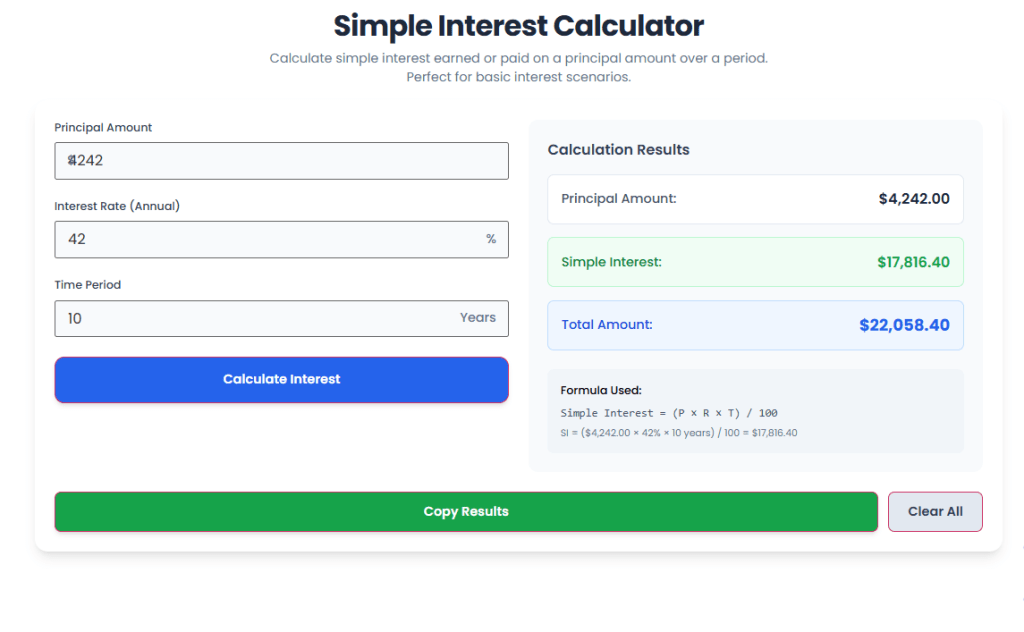

Calculate simple interest earned or paid on a principal amount over a period. Perfect for basic interest scenarios.

Calculate simple interest earned or paid on a principal amount over a period. Perfect for basic interest scenarios.

This simple interest calculator is a super useful financial tool. It’s made to quickly figure out how much basic interest you’ll earn or pay on an original amount of money over a certain time frame. It uses the straightforward formula SI = (P × R × T) / 100 to give you fast and precise answers. This handy tool completely skips the need for doing calculations by hand, giving you a smooth way to see exactly how much interest will build up.

How It Works

The calculator does its job using just three key pieces of information: the Principal Amount (P), which is the starting amount of money; the annual Interest Rate (R); and the Time Period (T), measured in years. Once you plug those numbers in, the calculator immediately shows you the Simple Interest amount and the total amount you’ll end up with (Principal plus Interest).

Who Should Use It

Students: It’s great for learning the basics of finance and checking homework answers.

Borrowers: It’s ideal for getting an idea of how much interest you’ll pay on short-term loans.

Lenders/Investors: It’s useful for projecting how much you might earn from investments that use simple interest, like bonds or short-term deposits.

Content Creators & Bloggers: You can embed this tool to easily give your audience quick financial value.

What Problems It Solves

This simple interest calculator solves the common problems of making calculation mistakes and wasting time when figuring things out manually. It gives you instant clarity on potential earnings or costs, helping you make faster and more informed financial choices.

When accuracy and speed are key, Toolota’s simple interest calculator really shines. Our tool is designed for maximum efficiency, delivering an outstanding experience that gets you results 10 times faster than you’d expect.

Trustworthiness: We use the mathematically proven simple interest formula, guaranteeing highly reliable results every single time.

Precision: It handles floating-point arithmetic with incredible accuracy, calculating amounts right down to two decimal places for precise financial planning.

Lightning Speed: Built with a clean, client-side JavaScript implementation, calculations happen instantly as you input your numbers, giving you immediate results without any server delays.

Unique Features: Our tool comes with a dynamic “Calculation Formula” display that shows you exactly which values were used in the math, giving you complete transparency into how the Simple Interest and Total Amount were calculated.

Sleek Interface: The interface is crafted using Tailwind CSS, ensuring a modern, responsive, and distraction-free experience. The color-coded result boxes (green for Interest, blue for Total Amount) make it super easy and quick to understand your financial details.

Ideal for Content Creators: The clean HTML and efficient script make it a breeze to embed into financial blogs or articles, instantly adding value for your readers.

The Toyota simple interest calculator is designed to be user-friendly, but it also handles complex calculations behind the scenes. At its heart, the tool follows a straightforward process: it checks the input data, performs the interest calculation, and then shows the results dynamically.

Looking at the inputs:

The calculator has three main fields where you can enter numbers:

Principal Amount (field labeled “principal”): This is where you enter the starting amount of money. It automatically adds a ‘$’ sign and allows you to enter amounts with up to two decimal places, ensuring your currency values are precise.

Interest Rate (field labeled “rate”): Here, you input the annual interest rate. A ‘%’ symbol appears immediately after your number to indicate that it’s a percentage.

Time Period (field labeled “time”): This is for the length of the loan or investment, measured in years. The label “Years” is shown right next to the field to make it clear.

Calculation and Output Conversion

When the “Calculate Interest” button is clicked, or when you press ‘Enter’, the JavaScript function `calculateSimpleInterest()` kicks into action.

Input Parsing: The input values are turned into floating-point numbers using `parseFloat`.

Validation: The script checks if all the inputs are positive and not zero. If they’re not, an alert pops up to ask you for valid values.

Core Calculation: The Simple Interest (SI) is calculated using the formula: SI = (principal * rate * time) / 100. Then, the Total Amount is figured out: Total Amount = principal + simpleInterest.

Display Formatting: All the resulting monetary figures are formatted using `new Intl.NumberFormat` for US Dollars ($), making sure they’re presented in a standard, easy-to-read currency format with two decimal places.

Right Panel Features:

Result Display: The calculated Principal, Simple Interest, and Total Amount are automatically updated in the dedicated results section.

Formula Display: A cool feature shows the Formula Used and plugs in your input values into the equation: SI = (P × R × T) / 100. This clear breakdown helps you understand the process and builds trust.

Enhanced Features (Copy / Clear)

Copy Results (id=”copy-btn”): This handy button gathers all the information you’ve entered – your input details and the final calculation results – into one neat block of text. It then uses a method called `document.execCommand(‘copy’)` to place that complete summary onto your computer’s clipboard, so you can easily paste it elsewhere. You’ll see a subtle, temporary message pop up just to let you know the copy was successful.

lear All (id=”clear-btn”): Clicking this button instantly wipes the slate clean. It resets all three input areas you filled out and sets the result display back to $0.00. This quickly gets the tool ready for you to start a new calculation from scratch.

These features are designed so that the tool isn’t just about doing the math; it’s also a clear and easy-to-use resource for understanding the process.

Making smart decisions about investing and borrowing is really important. That’s why having a trustworthy tool like our simple interest calculator is such a huge plus. Here’s why it makes a difference:

Accuracy You Can Count On: It uses the standard formula (SI = (P × R × T) / 100), so you avoid those pesky manual calculation mistakes. This means your financial guesses and plans are much more reliable.

Speed for Content Creators: If you create content, the tool’s simplicity and speed are great. You can whip up financial examples and scenarios for your audience right away, keeping them more engaged.

Better for SEO: The way the results are laid out is neat, using clear financial terms. This gives your embedded content great context, which is good for search engines.

Easy to Use Anywhere: Built with Tailwind, the design is responsive, clean, and easy to figure out on any device. This makes the whole calculation process super simple.

Clear Display, Fewer Mistakes: Even though it’s a calculator, the way the numbers and results are shown uses large text and clear labels. This really cuts down on accidentally reading things wrong or putting in the wrong numbers.

To make sure you get the most accurate results from our simple interest calculator, follow these easy guidelines:

Use Positive Numbers: The calculator needs positive numbers for Principal, Rate, and Time. If any of these are zero or negative, it will ask you to enter valid values.

Enter the Annual Rate: Always input the interest rate as an annual percentage (for example, type 5 for 5%).

Use Years for Time: Enter the time period in years (for example, 0.5 for 6 months or 2 for 2 years).

Double-Check Results: Although the tool is very accurate, it’s always a good idea to double-check the results, especially for important financial planning.

Use Responsibly: This tool is for calculating financial math only and should not be used for anything illegal or harmful.

If you want to learn more about the difference between simple and compound interest, you can explore those concepts further on Investopedia.

The formula used by the simple interest calculator is the classic $SI = (P \times R \times T) / 100$, where P is the Principal, R is the Annual Rate, and T is the Time in Years. The tool also transparently displays the exact values plugged into the formula, offering clear insight into the final interest calculation.

A2: The Toolota Repair PDF tool is expertly designed to fix PDFs that won’t open or display errors, have corrupted headers, contain missing or garbled fonts and images, are damaged from email transfers or incomplete downloads, and files that have become unreadable after a system crash.

Absolutely. The inputs in the simple interest calculator are standard number fields which can handle large values for Principal, Interest Rate, and Time. The JavaScript’s floating-point precision ensures that even calculations involving millions or billions of dollars remain accurate.

The easiest way is to use the “Copy Results” button. This feature compiles the Principal, Rate, Time, Simple Interest, and Total Amount into a formatted text block, which you can paste directly into an email, spreadsheet, or financial document, simplifying your record-keeping.

Toolota is your all-in-one online tools platform. Fast, simple, and free utilities designed to make everyday digital tasks easier and smarter.